As you are no doubt aware, taxes are due today in the United States. And while shelling out thirty bucks so TurboTax will file your state return is bad enough, here’s a Senate subcommittee hearing from 2012 entitled “Offshore Profit Shifting and the U.S. Tax Code” to really ruin your day.

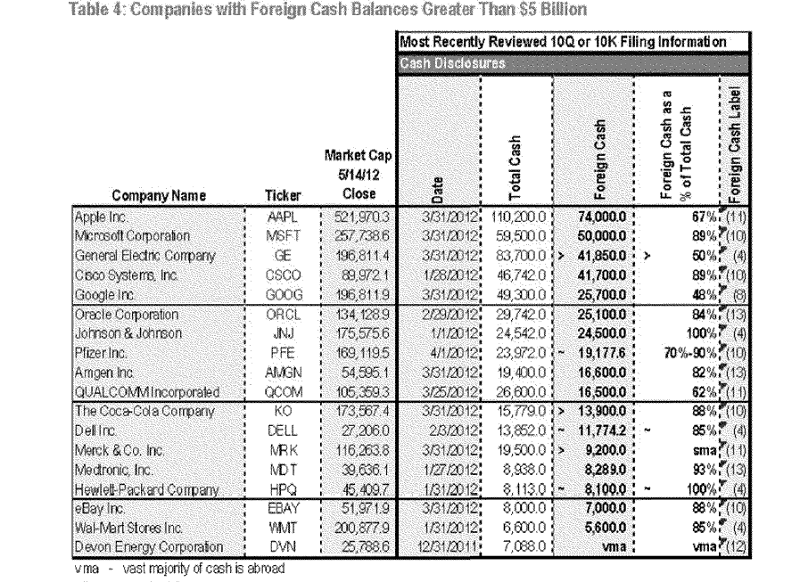

The report, released in response to an IRS FOIA request by MuckRock’s Todd Feathers for all communications with Senator Carl Levin regarding tax evasion, includes such day-ruining charts as this one …

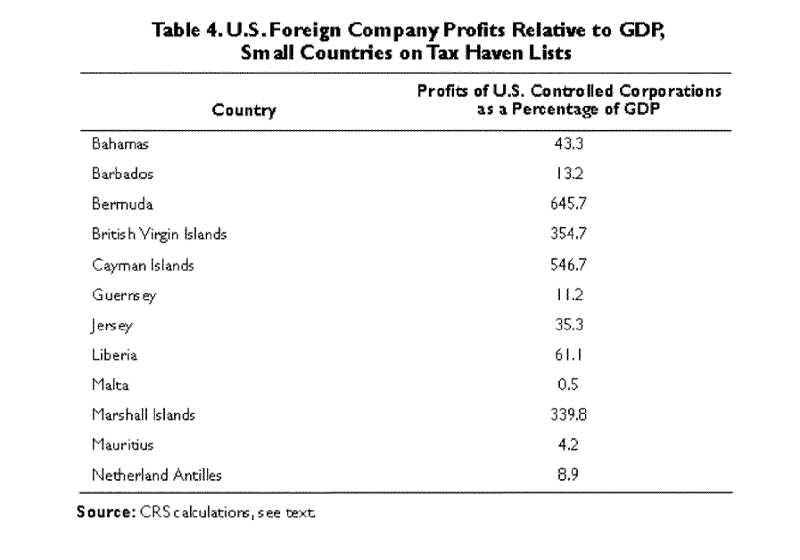

this one …

and of course, this one:

The whole request is worth reading, including the very first responsive email, which states that when a voluntary disclosure clemency program regarding offshore accounts was first put forth in September 2009, they had a couple thousand applicants.

A month later, after the Swiss government announced they would be eroding their famed bank secrecy laws that allowed corporations to keep funds hidden from the IRS, that number jumped to just shy of 15,000.

Hilarious!

Read through the report embedded below, on the request page, and don’t forget to invest your refund!

Image by Geraldshields11 via Wikimedia Commons and is licensed under CC BY-SA 3.0