Tennessee officials were surprised to learn that its state retirement system owned over 7,000 shares of stock in a real estate investment trust that provides capital for the medical marijuana industry.

So state Treasurer David Lillard ordered the Tennessee Consolidated Retirement System to sell its stock in Innovative Industrial Properties Inc. (NYSE: IIPR).

“There are policy implications to this,” Lillard told the Chattanooga Times Free Press.

Marijuana is not legal in Tennessee, not even for medical use.

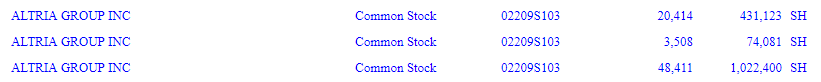

Tennessee, however, remains invested in other substances that, while legal, have major health policy implications. A review of the state pension fund’s most recent Securities and Exchange Commission filing shows the state is heavily invested in tobacco. It owns $72 million worth of stock in Altria, the parent company of Philip Morris USA, which boasts the most popular cigarette brand in the U.S., Marlboro.

It also owns $45 million worth of stock in Philip Morris International, a separate company that sells Marlboro and other tobacco brands overseas.

These investments dwarf the $700,000 investment the state had in IIPR, which was part of a stock fund focusing on small companies. State officials didn’t realize IIPR was part of this portfolio until the Chicago Sun Times published a story noting that the retirement systems of Tennessee and 10 other states stood to benefit from their investments in IIPR now that Illinois has legalized marijuana.

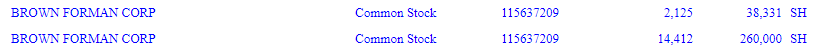

Tennessee also invests in alcohol. It owns $16.5 million worth of shares in BrownForman, which owns Tennessee’s iconic Jack Daniels whiskey distillery.

Other alcohol investments include $7.6 million worth of shares in Constellation Brands, maker of beers such as Corona, as well as liquor ranging from whiskey to tequila.

Tennessee’s largest stock holdings are companies that are found in the top five investments of many state pension funds: Apple, Amazon, Microsoft, Facebook and Alphabet, the parent company of Google.

Amazon is a key company for Tennessee after it announced in November that it plans to create 5,000 jobs at a new East Coast operations hub in Nashville. As part of the deal, Tennessee and Nashville offered the company up to $102 million in grants and tax credits, contingent upon the company reaching its job creation targets.

Tennessee also owns $376,000 worth of stock in Gannett, a company that owns the state’s three largest newspapers, and $127,000 in Sinclair Broadcasting Group stock. Sinclair owns television stations in Nashville and Chattanooga.

And while environmental activists are urging states to end their investments in coal, Tennessee owns $409,000 worth of stock in Arch Coal Co.

The state’s retirement system owns stock in hundreds of companies, and it earned a return of over 8 percent on its investments last fiscal year, according to the Tennessee Consolidated Retirement System’s annual report. Besides stocks, it invests in bonds, short-term securities, real estate and private equity. Assets totaled $50 billion as of June 30, 2018.

The full TCRS report is embedded below:

Image via Pexels