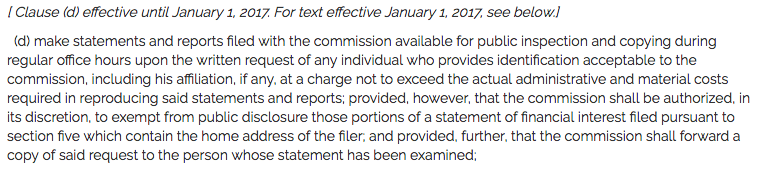

At least 29 states post Statements of Financial Interest online, making it easy to peruse your local official’s financial ties. But under the Massachusetts Financial Disclosure Law, those wanting to get a closer look at their lawmaker’s finances have to be okay with not only showing some identification, but having their name shared with the official in question.

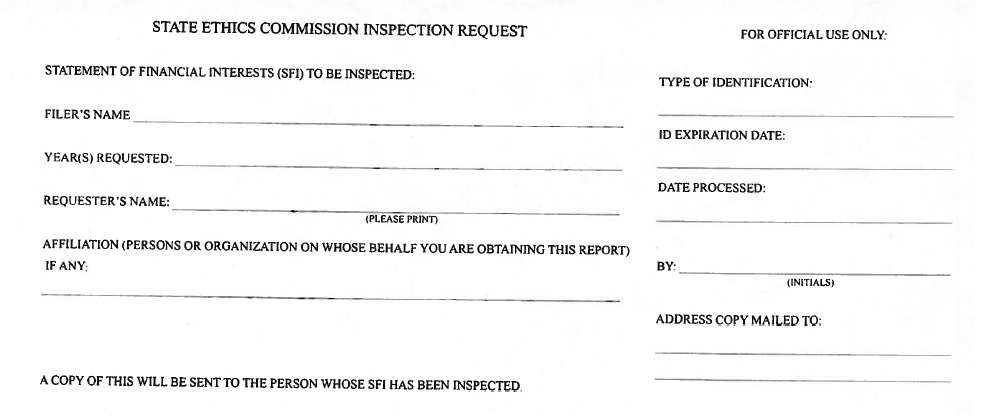

“The law does require that the Commission verify the ID of anybody requesting to view statements of finance interest,” said Public Information Officer for the Massachusetts Ethics Commission, Gerry Tuoti. “If there is no ID, then its possible the commission may work with them if they have another form of ID.”

On top of filling out a written request and showing a photo ID, those looking to get access are also told a copy of their request will be forwarded to the owner of the SFI. This means that your local official will know if you took a look at their filings.

“The commision is generally looking to obtain the name of a requester for purposes of the notification requirement,” added Tuoti.

According to Tuoti, there is no exemption for out-of-state residents looking for access. In addition, those seeking access to SFI records are given credentials to view them through an online module hosted by the Commission. You can browse a list of all the individuals required to file an SFI on a given calendar year beginning with 2015. Those wanting to see SFI’s prior to 2015 would have to file an additional request and if applicable, pay a fee to see a redacted copy.

“[Fees] would depend on the scope and the nature of the request. The Ethics Commission reserves a right to charge a fee in the event it receives a public records request that would require significant staff time and resources to fulfill,” said Tuoti.

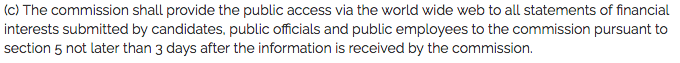

At the legislative level, lawmakers have been trying to push for increased transparency into these records. In 2015, Representative Carolyn Dykema (D-Holliston) introduced Bill H. 2732 to allow the public access into these records and enforce the maintenance of an electronic reporting system for SFI’s. Although a module exists today on the State Ethics Commission site, those looking for access still have to request it. Originally, H. 2732 asked to give the public access to these records no later than three days after the information is received by the Commission.

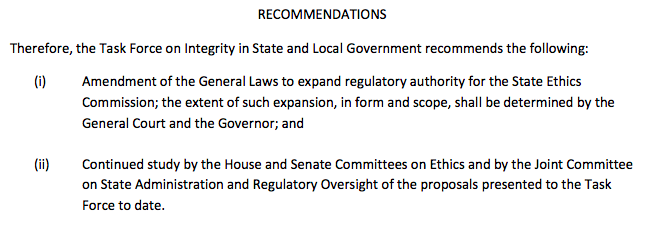

Similarly in 2017, the Task Force on Integrity in State and Local Government issued its own set of recommendations to expand the Commission’s regulatory power. Although not much has changed in regards to financial disclosure law, the Commission continues to abide by the existing laws set in place by the Massachusetts Government.

At the Federal level, Senator Elizabeth Warren (D-MA) reintroduced the Presidential Conflicts of Interest Act, requiring the Vice-President and President to fully disclose their financial conflicts of interests. Current law exempts both presidents and vice-presidents from a number of financial conlfict of interest laws as well as FOIA laws. Following the reintroduction of the act, Senator Warren released her own tax returns showing her and her husband paying about $200,000 in taxes.

It remains unclear if the Massachusetts legislature is considering new pathways to provide increased transparency into these types of records.

The Task Force on Integrity in State and Local Government’s report is embedded below.

Do you have your own public records struggle in Massachusetts? If so, let us know via the form below.

Image by Kenneth C. Zirkel via Wikimedia Commons is licensed under CC BY-SA 4.0